Given the following information from an amortization table for December 31 prepare the journal entry to record the payment of interest at year end if the fiscal year of the company ends on. Test Bank for Intermediate Accounting Sixteenth Edition 1 - 2.

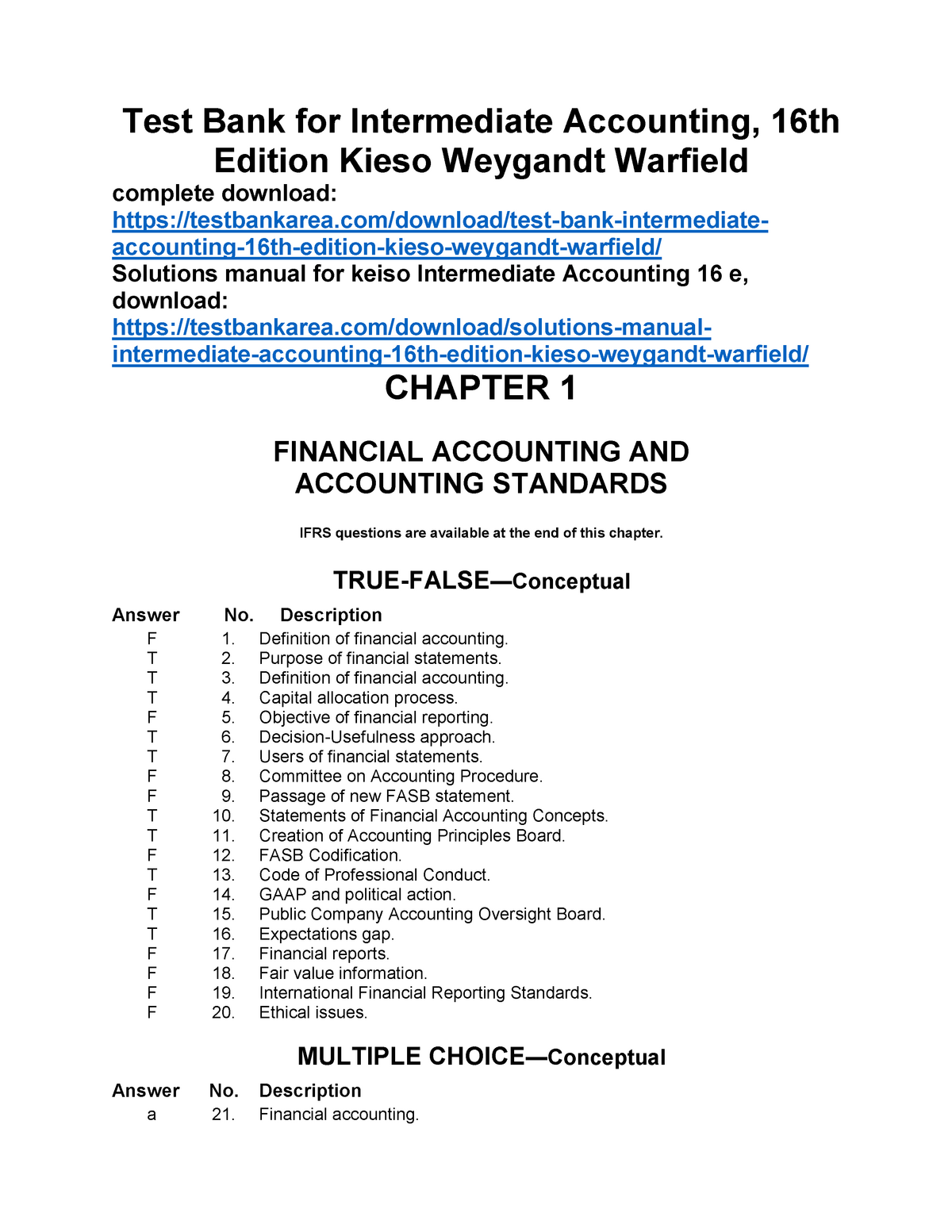

Test Bank For Intermediate Accounting 16th Edition Kieso True False Conceptual Answer No Studocu

Learn vocabulary terms and more with flashcards games and other study tools.

. Test bank for Intermediate Accounting 17. View Test Prep - intermediate-accounting-final-exam-solutions from ACCT 413 at University of Delaware. Intermediate Accounting II Final Exam Take this practice test to check your existing knowledge of the course material.

Save Money With Expert-Made Job Tests. Test banks may contain any. Acct208 test 1 study guide.

Download the free sample and see how we can help you get the grades. Identify the major financial statements. View Intermediate Accounting Final Exampdf from ACCOUNTING 113 at University of Southern Philippines Foundation Lahug Main Campus.

Calculate depreciation using 150 declining balance. Studying ACC 3313 Intermediate Accounting I at Texas State University. The Test Bank for Intermediate Accounting 10th Edition By Spiceland will help you get ready for your upcoming exam.

Supplementary information may include details or amounts that present a different. Test Bank for Intermediate Accounting Fourteenth Edition 11 - 4 MULTIPLE CHOICE CPA Adapted Answer No. An analysis of Patrick Corps unadjusted prepaid expense account at Dec 31 Year 2 revealed the following.

A test bank is a collection of test questions tailored to the contents of an individual textbook. On StuDocu you will find 12 Lecture notes Practical Mandatory assignments Tutorial work and. The Avg Cost Of A Mis-Hire Is 200 Of Annual Salary.

Exams Log out My Students Book Solutions Video Tutoring Test Bank Exams Log out INTERMEDIATE ACCOUNTING TEST BANK CHAPTER 7. Intermediate Accounting Final Exam. INT E R ME DIA T E A CCOU NT ING FINA L E XA M S OLU T IONS.

Revenues are recognized in the accounting period in which the performance obligation is satisfied. The Test Bank for Intermediate Accounting 9th Edition By Spiceland will help you get ready for your upcoming exam. Exams Log out My Students Book Solutions Video Tutoring Test Bank Exams Log out INTERMEDIATE ACCOUNTING TEST BANK CHAPTER 4.

Start studying Intermediate Accounting I Final Exam. Ad Hiring Remotely Made Easy. Many instructors rely on these resources to develop their exams.

The Test Bank for Intermediate Accounting 17th Edition By Kieso will help you get ready for your upcoming exam. Well review your answers and create a Test Prep. Learn vocabulary terms and more with flashcards games and other study tools.

Make Unbiased Decisions On The Best Candidates. Accounting II ACCT 208 T est bank for Intermediate A ccounting. Recording an expense and a liability each period.

Test Bank for Intermediate Accounting 17th Edition By Kieso. Intermediate Accounting 17th Edition is written by industry thought leaders Kieso Weygandt and Warfield and is developed around one simple proposition. Users of financial reports.

Saturday October 10 from. ACCT208 ch2 study guide. Start studying Intermediate Accounting Final Exam - Chapter 10 PPE.

Test Bank for Intermediate Accounting 9th Edition By Spiceland. - An opening balance at 1500 for Pats comprehensive insurance policy. Accounting for costs of incentive programs for frequent customer purchases involves.

Intermediate Accounting Exam 3 Study Guide Acco 3001 Studocu

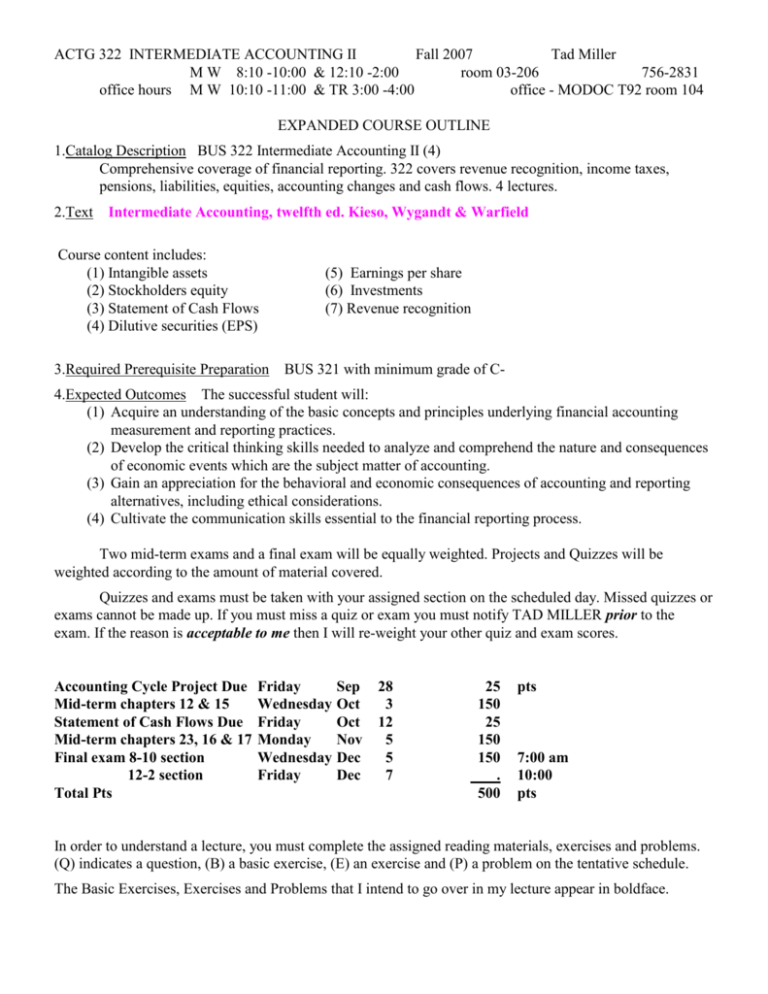

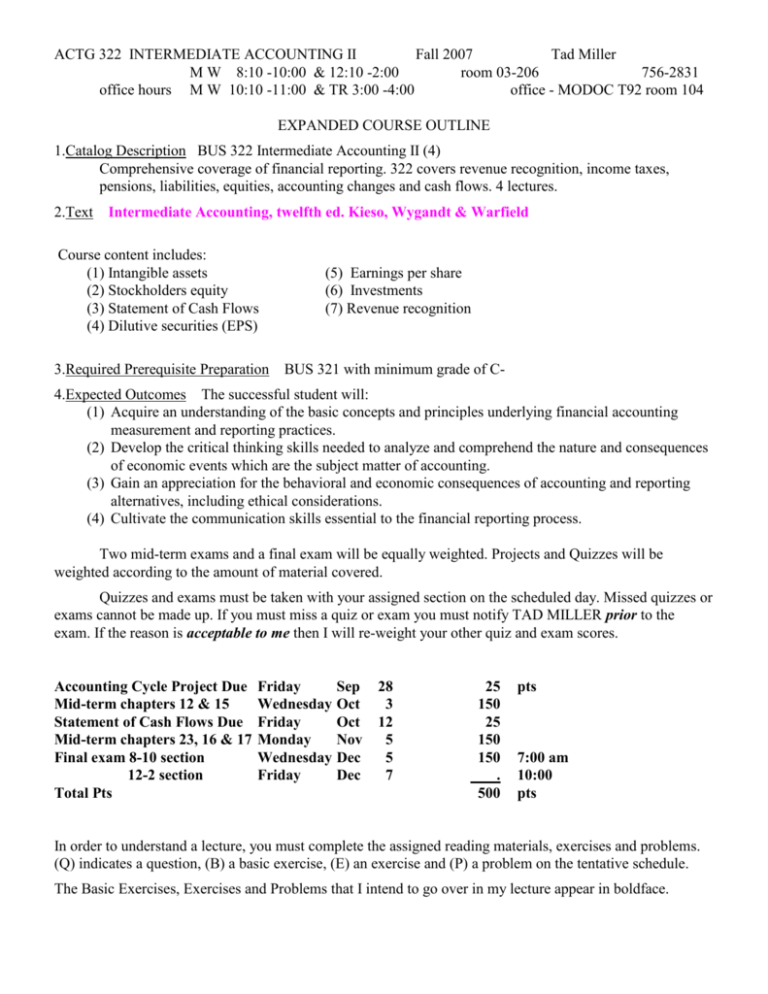

Actg 322 Intermediate Accounting Ii

Intermediate Accounting 17th Edition Kieso Test Bank By Alibabadownloadwide Issuu

Solved 23 40 Test Bank For Intermediate Accounting Chegg Com

Intermediate Accounting 17th Edition Kieso Test Bank By Alibabadownloadwide Issuu

Acc 303 Complete Class Intermediate Accounting I

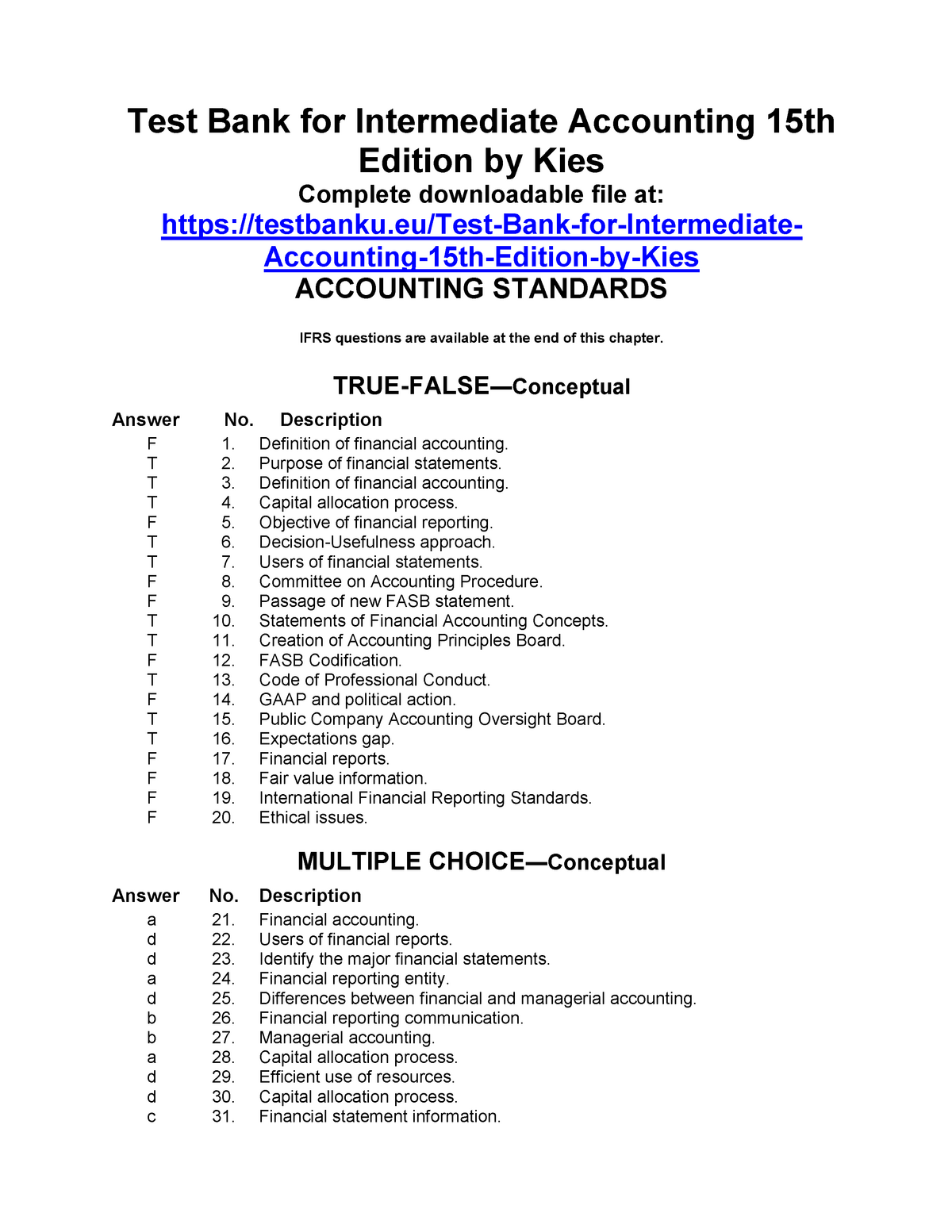

Test Bank For Intermediate Accounting 15 Bs Information Csu Studocu

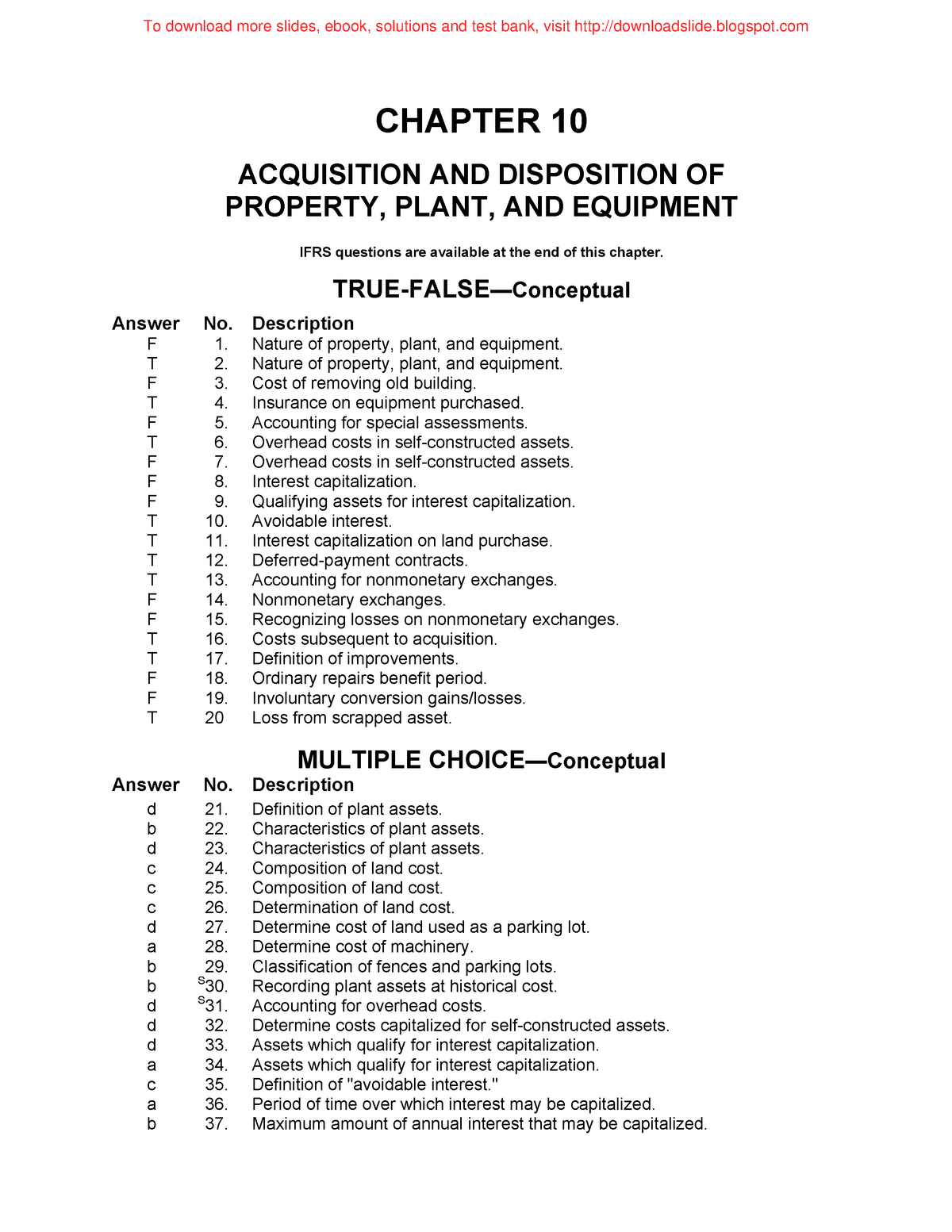

Chapter 10 Test Bank This Test Bank May Help You Take A Look Studocu

0 comments

Post a Comment